The surprise move to decrease the rate to 3.75% will act to strengthen the economy's ability to meet the challenges confronting it

The Bank of Israel (BOL) lowered last Tuesday its key borrowing rate by 0.5%, citing "the sharp increase in uncertainty" in markets worldwide and its impact on local financial market.

The surprise move to decrease the rate to 3.75%, which took effect on Sunday, October 12th, will act to strengthen the economy's ability to meet the challenges confronting it.

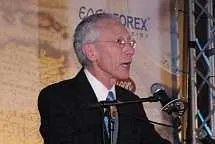

In a statement issued by the Bank Gov. Stanley Fischer said: "Since the deterioration in the global financial crisis, with its implications for the domestic markets, the chances of a slowdown in Israel's rate of economic growth in the near future have risen".

Noting that inflationary pressures in Israel areexpected to ease significantly due to the continued fall in world commodity prices and the expected slowdown in economic growth, the bank said that the rate cut will serve to increase liquidity in the increasingly volatile domestic financial markets. Inflation expectations for the next 12 months, the central bank said, are now within its inflation-target range of 1% to 3%. Inflation in the 12 months through August ran at a 5% rate.

Israel's Central Bank made surprise interest rate cut amid market uncertainty

The surprise move to decrease the rate to 3.75% will act to strengthen the economy's ability to meet the challenges confronting it

00:00 ,12.10.2008

-

Found it useful? Share

-

Share on Facebook

-

Share on X

-

Share on LinkedIn

-

Share via Email

-

Share on WhatsApp

-

Print Article

Related

28.09.2008

28.09.2008

Daskal: 2008 Daylight Savings Time saved economy NIS 70m

28.09.2008

28.09.2008

Israeli Businessmen at Adam Muszka Paintings Show

28.09.2008

28.09.2008

IAI's Bedek: $100m contract for B767-200 cargo conversions

28.09.2008

28.09.2008

Customs Authority: Contract to develop a new foreign trade management system

28.09.2008

28.09.2008

CBS: Israel's population 7.3 million on eve of Jewish New Year

28.09.2008

28.09.2008

CBS: Economy set to grow 4.5% in 2008